How Republicans’ Endowment Tax Will Hurt Higher Education

Politics

/

StudentNation

/

July 7, 2025

As the Trump administration escalates its campaign to reshape education, a provision in the “Big Beautiful Bill” will raise the tax on select private colleges’ endowments.

Donald Trump stops in the White House Cross Hall to listen to the band at the conclusion of a “One, Big, Beautiful” event.

(Chip Somodevilla / Getty)

When President Trump first signed a bill in 2017 eliminating the tax-exempt status many private university endowments enjoyed, Rep. Kevin Brady—the key congressional Republican overseeing the tax code rewrite as chairman of the powerful Ways and Means Committee—said the goal of the new tax was “pretty simple: It encourages colleges to use their major endowments to lower the cost of education.”

In the face of a further tax increase on a small subset of private colleges in the United States, the GOP’s rationale has shifted. Brady’s successor, Rep. Jason Smith, has pitched the increased levies as a way to hold “elite, woke universities and nonprofits accountable.”

Tucked inside Republicans’ 800-plus page “One Big Beautiful Bill” is a provision raising the tax on earnings from select private college endowments from its current 1.4 percent rate to anywhere from 4 to 8 percent. The levy is calculated by dividing the size of the school’s endowment by the number of non-international students they enroll, outputting a number representing the amount of money held in the endowment per student. The higher the per-pupil endowment rate, the higher the tax. This creates an incentive structure, Republicans argue, that encourages colleges to spend more of its endowment on financial aid and the students’ learning experience, rather than hoarding its wealth into what are effectively hedge funds. But higher education experts dispute this, asserting that endowments serve to lower the cost of the education.

In a survey of 645 U.S. institutions by the National Association of College and University Business Officers, financial aid accounted for nearly half of all endowment spending. Academic programs and research accounted for another 17 percent and faculty positions for nearly 11 percent. “Faculty and staff certainly benefit from this philanthropy, but students remain the primary beneficiaries, as the bulk of these resources is used to maintain student aid and affordability,” NACUBO President and CEO Kara Freeman said.

Increasing the tax burden for these colleges could divert funds from these programs, negatively impacting access to education, Phillip Levine, a senior nonresident fellow at the Brookings Institution and an economics professor at Wellesley College, told The Nation. “These highly endowed colleges are the least expensive college options for students below perhaps $150,000 in income per year,” he said. “They are able to do that because of their large endowments.”

Another GOP qualm, in the words of Smith, is that colleges have used their multibillion dollar slush funds to push political ideology. “That ends now. If these institutions want to act like corporations, we’ll treat them like corporations.”

Current Issue

Endowments, however, have strict rules governing them. The amount of money that can be pulled from them annually is regulated by state laws. Donors also stipulate how their money can be used. Some donate to endow professorships. Others donate to increase student financial aid, fund construction of a building, or fund research.

Existing in a largely tax-exempt world since the early 1900s, higher education institutions have enjoyed a federal tax carveout due to their mission and contribution to civil society. “Higher education absolutely has a civic responsibility,” Director of Post-Secondary Policy at Education Reform Now James Murphy said in an interview, citing its ability to provide social mobility to its students and advance scientific inquiry.

Steven Bloom, assistant vice president of government relations for the American Council on Education, went as far as to call American higher education “a national security asset.” “They are a magnet for the world’s brightest students and scholars,” he argued.

In a 2019 paper Mae C. Quinn, a law professor at Penn State, argued that colleges could simply use the funds in the endowments in ways that make higher education more equitable, such as on financial aid. Spending down these endowments would exempt them from a tax while simultaneously benefiting disadvantaged groups who are under threat from the Trump administration, she argues. “If rich colleges simply utilize more of their massive savings to further social justice, impact poverty, and enhance public good—particularly in their own at-risk communities—they will not only avoid federal taxation but also begin to address critiques about their elitism and greed,” she wrote during Trump’s first term.

But as the Trump administration escalates its campaign to reshape U.S. post-secondary education through withholding billions in federal funds and launching countless investigations, this latest tax is seen as punitive by education stakeholders across the political spectrum.

“The tax is explicitly directed at ‘woke’ universities,” said Neal McCluskey, the director of Center for Educational Freedom at the Cato Institute, a libertarian think tank. “The tax system should not be used to punish people for their ideological beliefs.” But McCluskey does think that the federal government should cut off all funding to higher education, “not to punish higher education but to follow the Constitution, which gives Washington neither the authority to fund student aid nor most research.”

Popular

“swipe left below to view more authors”Swipe →

Hillsdale College follows this model. A conservative-leaning, religious institution, Hillsdale refuses any federal funding since its founding in 1844, pointing out that government funding can come with strings attached. Yet its president, Larry Arnn, publicly rebuked the endowment tax arguing that “it penalizes most severely those institutions that have chosen the harder path of independence, that refuse the entanglements of federal subsidy.”

Receiving much of its funding through philanthropic gifts, the college’s president argued that “to tax these gifts is to tax philanthropy itself—to burden those who would lift burdens.” If the tax were to go into effect, Arnn said, “It would force us to cut resources, to limit opportunities, to pass burdens onto students and their families—all in the name of a fairness that is not fair.”

Other colleges expressed similar alarm, predicting doomsday scenarios when Trump enacted such a levy. On Friday, Trump signed the legislation, and the new tax, into law. The Nation reached out to dozens of colleges to understand how they are preparing for a potential tax hike and how it would affect their students. Only one provided a response, Baylor College of Medicine, to say that they didn’t believe the tax was meant to target small, private medical schools. Their General Counsel Robert Corrigan added that “we are currently working with our elected representatives to effect a solution to this issue.”

These institutions have lobbied extensively on Capitol Hill against such proposals to raise the tax, according to public disclosure documents reviewed by The Nation. Bloom lobbies about these taxation issues on behalf of the American Council on Education, an organization composed of 1,600 higher education institutions. His pitch to lawmakers against the tax evokes traditional Republican themes of a small federal government. By taxing these earnings, he argues, “you take the money away from other useful purposes and send it to Washington.”

Some in higher education are still fighting against the endowment tax, but are open to reforms. Murphy proposed leveraging the punitive measure of a tax to spur colleges into working toward “desirable outcomes.” In his view, this would include tax breaks for those who eliminate legacy preferences in admissions or surpass a threshold in the percentage of students enrolled who are Pell Grant eligible. Bloom said the ACE wants the tax repealed or “reformed in ways that enhance that incentivize schools to do more in terms of financial aid, and research.”

More from The Nation

Not Giving Away Our Shot.

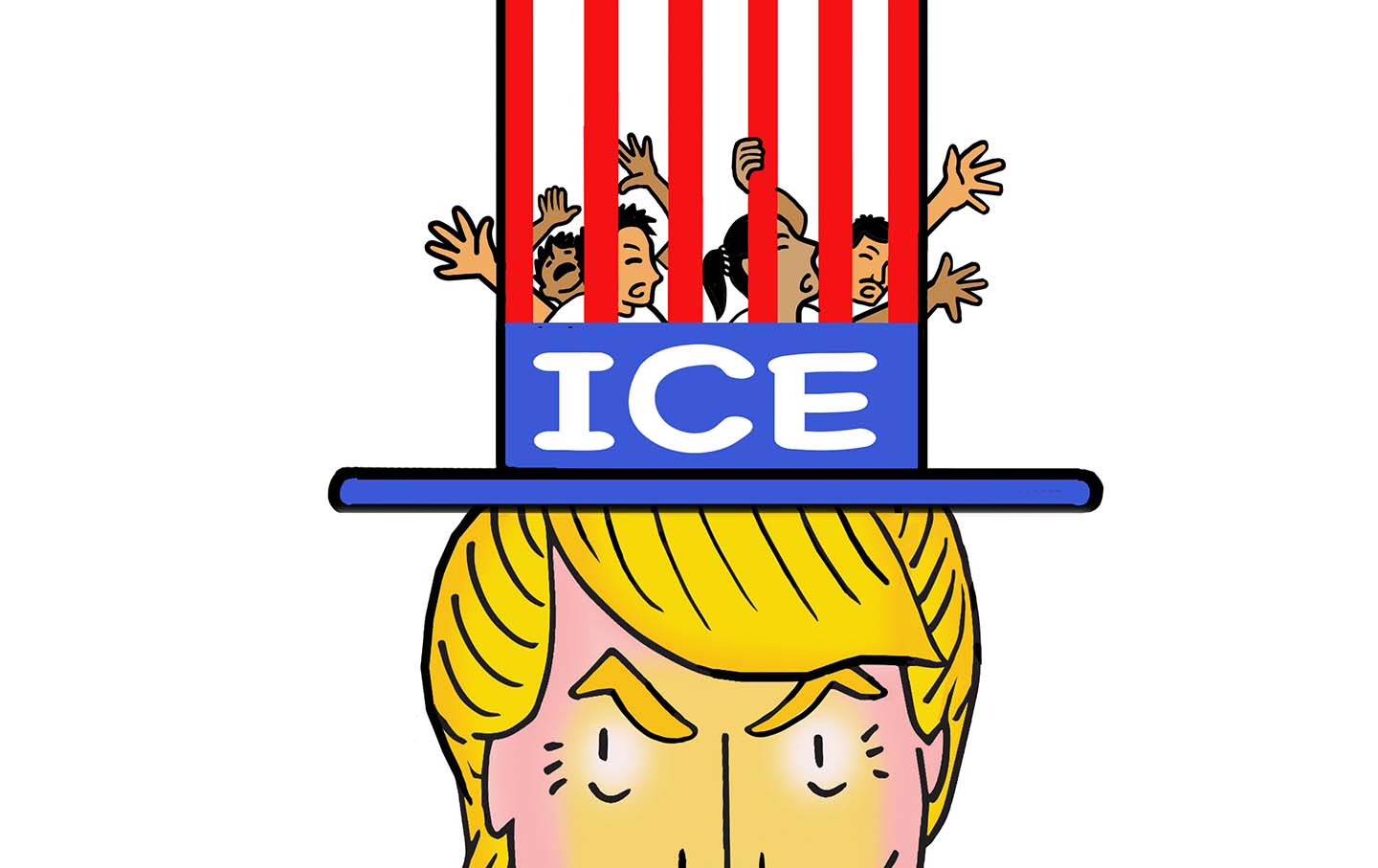

ICE is making more arrests than ever, the vast majority of people detained this fiscal year had no criminal convictions, and Trump is pushing for more enforcement.

OppArt

/

Felipe Galindo

By attacking equality of citizenship, MAGA is smashing the foundations of national pride.

Jeet Heer

Issues once thought long settled are now up for grabs again. But, “they’re not going to get what they want,” says Omar Jadwat of the ACLU’s Immigrants’ Rights Project.

Sasha Abramsky

The GOP chose to betray both morality and economic common sense by approving Trump’s one big, ugly bill.

John Nichols

Post Comment